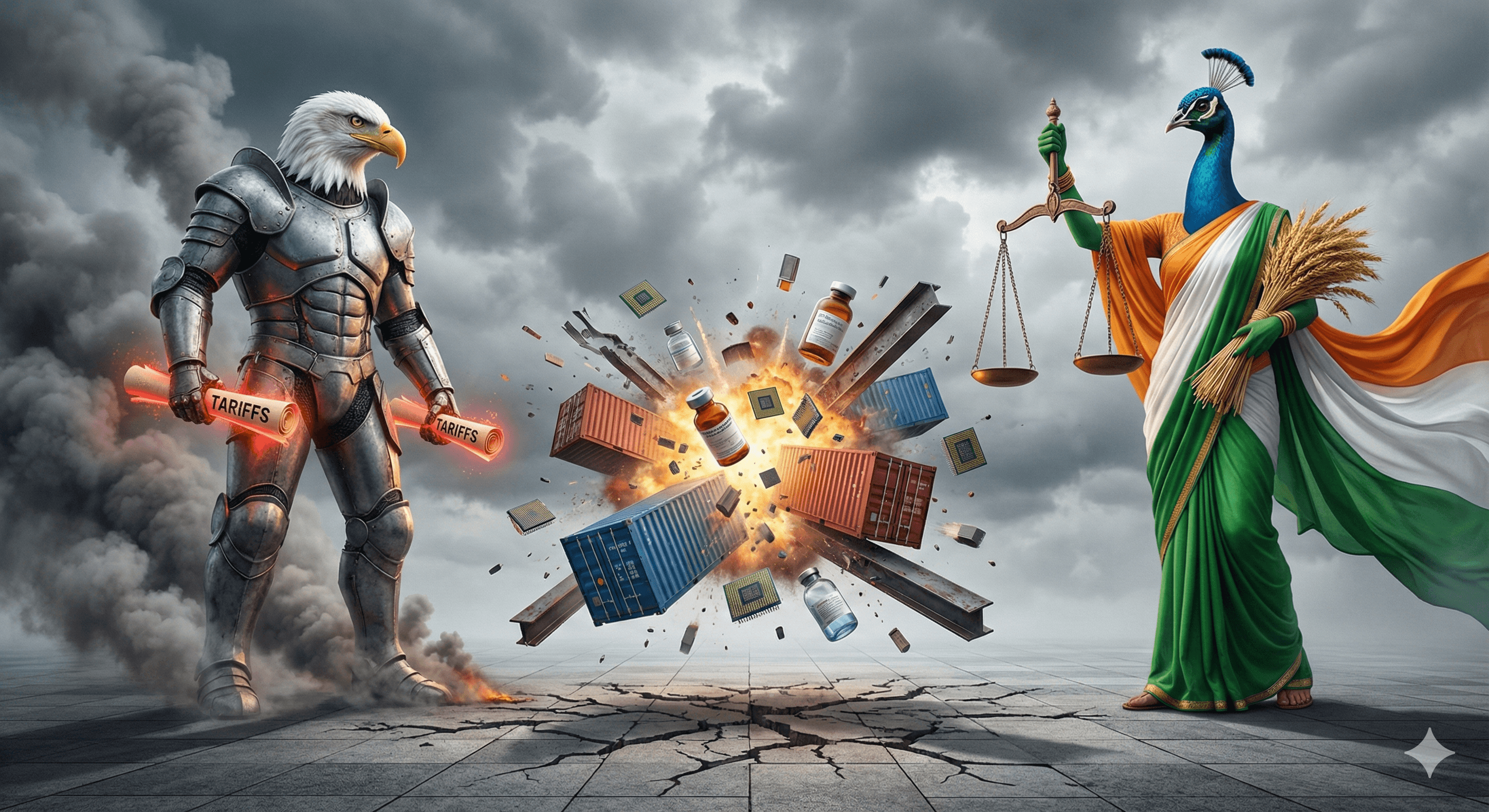

When Allies Collide: The Impact of U.S. Tariffs on India’s Growth Story

Author Name

Research Fellow

The United States and India share one of the most significant bilateral trade relationships of the 21st century, with goods and services trade exceeding USD 190 billion in 2023. Traditionally rooted in economic complementarities Indian exports of pharmaceuticals, textiles, and IT services balanced against U.S. exports of machinery, aircraft, and agricultural products the partnership has recently come under strain. The escalation of U.S. tariff measures against Indian exports in 2025 represents a critical disruption, raising concerns about India’s growth trajectory and its positioning in an increasingly fragmented global trade system.

In August 2025, the U.S. imposed an additional 25% tariff on Indian exports, layered atop an existing 25% reciprocal duty, pushing total tariffs on several product categories to as high as 50%. These measures were explicitly linked to India’s continued imports of Russian oil amid the Ukraine conflict. The tariffs target labor-intensive and employment-heavy sectors such as textiles and apparel, gems and jewellery, shrimp and seafood, leather goods, furniture, chemicals, engineering products, auto components, and metals. Collectively, these sectors account for over half of India’s merchandise exports to the U.S. Early indicators suggest suspended orders and a projected 20–30% decline in export volumes beginning late 2025. Notably, pharmaceuticals and electronics including semiconductors remain exempt, providing temporary relief to strategically important export segments. The economic implications are significant. India’s merchandise trade deficit rose to an eight-month high in mid-2025, driven by rising imports and modest export growth. A pre-emptive surge in shipments to the U.S. earlier in the year masked underlying vulnerabilities that are now becoming apparent. Simultaneously, India’s trade deficit with BRICS countries has widened sharply, complicating its external balance amid U.S. tariff pressure. Economists warn that retaliatory escalation could trigger higher import costs, inflationary pressures, currency volatility, and job losses in labor-intensive industries—undermining India’s manufacturing and export-led growth ambitions.

From the U.S. perspective, the tariff escalation reflects a broader turn toward protectionism, shaped by domestic political incentives, supply-chain security concerns, and efforts to reshore manufacturing. While such policies may offer short-term relief to select industries, critics argue they undermine business confidence, deter investment, and risk isolating the U.S. within a multipolar global economy. Prominent economists caution that protectionism accelerates trade diversion rather than restoring competitiveness. Geopolitically, the tariffs have accelerated India’s strategic recalibration. While maintaining engagement with Washington, India is deepening ties with the Global South through platforms such as BRICS+, ASEAN, and South–South trade corridors. Expanded engagement with ASEAN, Latin America, and Africa offers alternative markets and supply-chain resilience. At the same time, India continues to assert strategic autonomy balancing U.S. relations with participation in multipolar forums and maintaining a calibrated stance on sensitive issues such as Taiwan.

Looking ahead, India’s response requires a multi-pronged strategy: pursuing WTO remedies and diplomatic engagement, strengthening domestic competitiveness through infrastructure and logistics reforms, supporting export-oriented SMEs, and accelerating market diversification. While U.S. tariffs pose short-term challenges, they also underscore the necessity of structural reform and strategic diversification. India’s ability to navigate this disruption will shape not only its growth story but also its role as a pivotal emerging economy in a fragmented global trade order.

Related Reads for You

Discover more research and analysis on topics shaping the Indo-Pacific.