Biosecurity, Friendshoring, and the Future of Pharma: Navigating US Regulatory Shifts

Author Name

Research Fellow

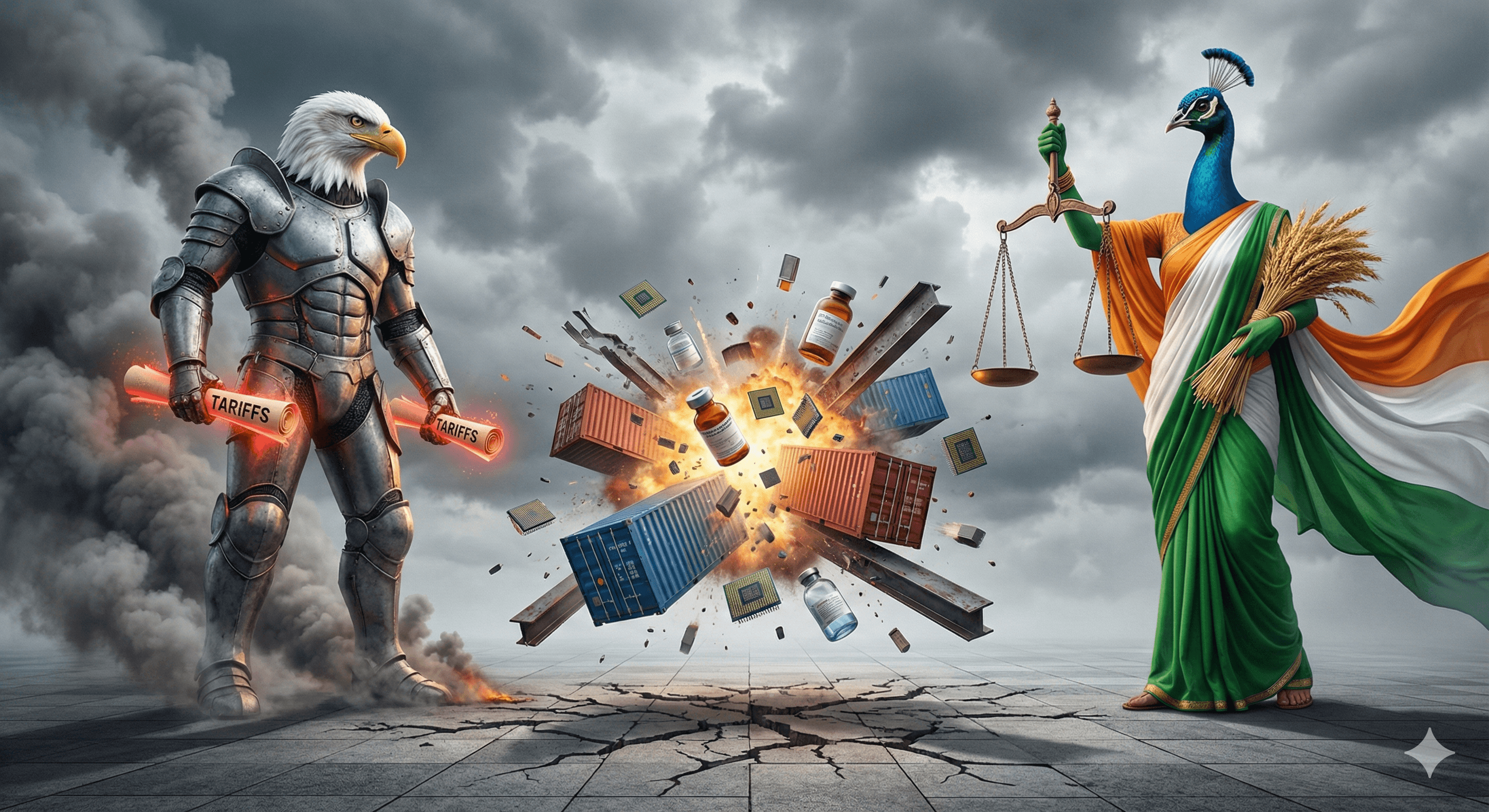

The global biopharmaceutical ecosystem is undergoing its most profound transformation in decades. Driven by Washington’s BIOSECURE Act, tightened FDA oversight, and concerns around supply chain concentration, U.S. policymakers have begun reshaping the regulatory landscape to reduce dependence on China for critical pharmaceutical ingredients and manufacturing. The result is a strategic realignment that is forcing companies, suppliers, and governments to reevaluate their long-term operational and geopolitical positions.

At the heart of this transition is the concept of friendshoring — the deliberate redistribution of essential supply chain nodes toward allied or geopolitically stable partners. For the U.S., this means diversifying away from China, which currently holds a dominant position in APIs, precursor chemicals, and active pharma manufacturing. Companies now face elevated compliance risks, new reporting standards, and rising scrutiny over the origin of critical components.

This shift is driving the emergence of two parallel pharmaceutical ecosystems. One is aligned with Western regulatory expectations — emphasizing compliance, transparency, and resilience. The other is more cost-competitive and China-centered, continuing to prioritize scale, speed, and manufacturing intensity. The divergence is expected to widen between 2026–27 as new U.S. regulatory deadlines approach and global firms prepare for compliance audits.

For India, this transformation presents both challenges and opportunities. Although India is a leading generics producer, its own dependence on Chinese APIs remains a structural vulnerability. However, the global push for diversification creates openings for India to strengthen domestic production, attract new investments, and reposition itself as a reliable partner for Western markets. Strategic initiatives such as Production-Linked Incentive (PLI) schemes, API parks, and strengthened quality frameworks will be essential.

As companies recalibrate their network design, supply chain mapping, and sourcing strategies, geopolitical forecasting becomes increasingly critical. The pharmaceutical sector is no longer insulated from geopolitics — it is now shaped by it. For governments, the question is not only how to secure medical supply resilience, but how to build long-term partnerships that balance cost, reliability, and strategic autonomy.

Key Findings:

U.S. biosecurity policies are accelerating a permanent shift away from China-based pharma supply chains.

A two-track global biopharma ecosystem is emerging: Western compliance-driven and China-centered efficiency-driven.

India has a strategic opportunity to become a preferred friendshoring destination but must address API dependence.

Regulatory tightening will reshape corporate supply chain design through 2026–27.

Geopolitics is becoming a central determinant of pharmaceutical supply resilience.

Policy Implications:

India should expand incentives for domestic API manufacturing to reduce China reliance.

Strategic partnerships with the U.S., EU, and Japan could enhance resilience and attract investment.

Regional cooperation mechanisms (Quad, IPEF) should integrate pharma security as a core agenda area.

Governments must anticipate long-term supply chain bifurcation and plan for dual regulatory compliance environments.

Related Reads for You

Discover more research and analysis on topics shaping the Indo-Pacific.